India’s electric two-wheeler market is expanding rapidly. Rising fuel prices, lower running costs, improved charging infrastructure, and strong government support are encouraging more consumers to shift toward electric scooters. At the same time, growing awareness about pollution and sustainability is accelerating EV adoption across the country.

The numbers clearly show this momentum. Last month, Indian manufacturers collectively sold 1,22,812 electric two-wheelers, compared to 98,427 units in January 2025. This represents a strong 24.77% year-on-year growth, proving that demand for EV scooters is steadily increasing.

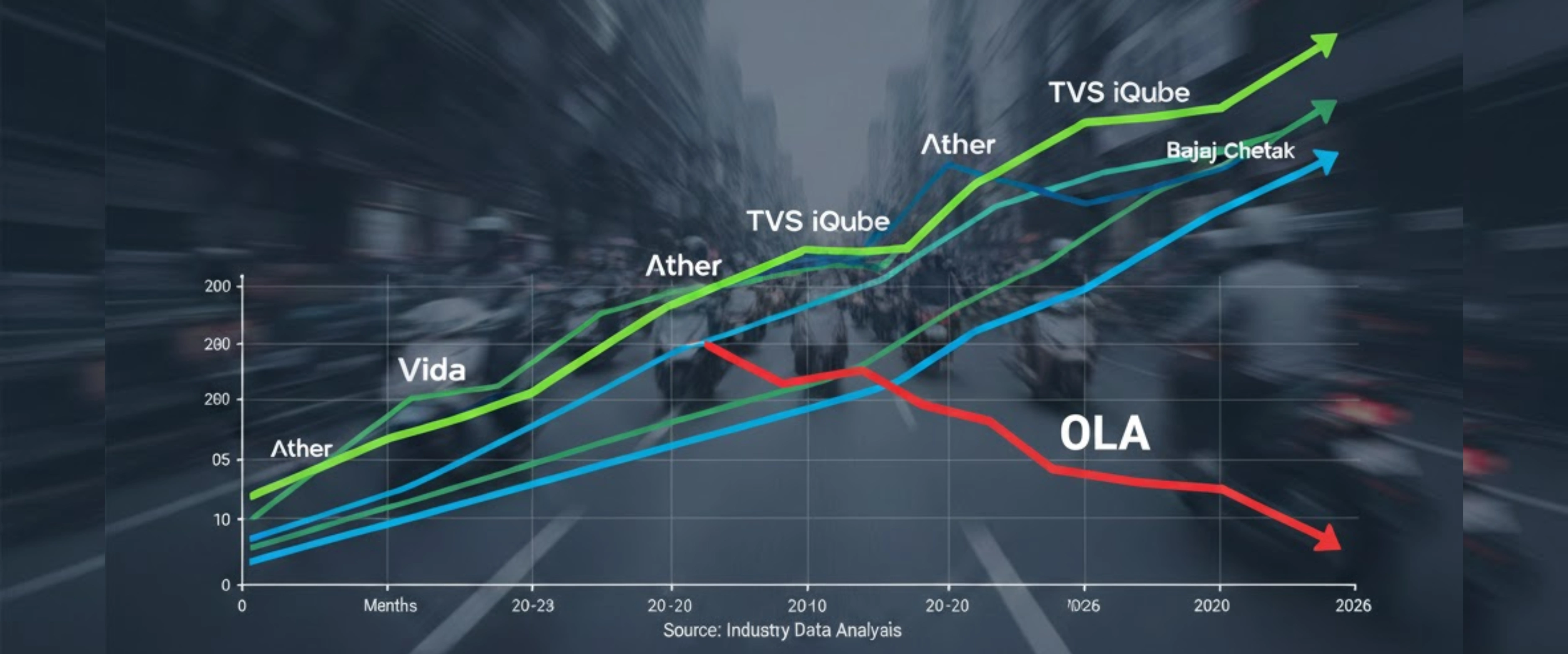

However, despite this overall market growth, one major brand — Ola Electric — has recorded a sharp decline in sales, while competitors continue to grow.

In this report, we will first look at the brand-wise sales performance and then understand the key reasons behind Ola’s unexpected slowdown.

Brand-Wise Electric 2-Wheeler Sales Report (Latest Month)

1. TVS Motor Company – Market Leader

TVS is now the number one electric two-wheeler brand in India.

Latest month sales: 34,558 units

January 2025 sales: 24,028 units

Growth: 43.82% increase

TVS has gained strong customer trust due to better service network, product reliability, and brand reputation. Their consistent growth shows customers prefer established brands with stable after-sales support. The company’s focus on innovation, diverse EV portfolio, and competitive pricing continues to attract first-time EV buyers as well as loyal TVS customers, cementing its position at the top.

2. Bajaj Auto – Second Position

Bajaj has secured the second spot in EV sales.

Latest month sales: 25,598 units

January 2025 sales: 21,470 units

Growth: 19.23% increase

Bajaj is benefiting from strong dealership networks and growing acceptance of its electric scooter lineup. Its reputation for durable, performance-oriented vehicles and wide service reach gives buyers confidence, making Bajaj a reliable alternative for those seeking proven electric two-wheelers.

3. Ather Energy – Strong Growth Performer

Ather is in third position and showing impressive growth.

Latest month sales: 21,999 units

January 2025 sales: 13,097 units

Growth: 67.97% increase

Ather is known for premium electric scooters, smart features, and good customer experience. Their rapid growth shows rising demand for tech-focused EVs. With a focus on futuristic designs, software-driven updates, and connected mobility, Ather is capturing the imagination of younger buyers who value technology as much as performance.

4. Vida – Massive Growth

Hero’s EV brand Vida has shown explosive growth.

Latest month sales: 13,302 units

January 2025 sales: 1,626 units

Growth: 718% increase

This massive jump helped Vida move ahead of Ola. The brand is benefiting from Hero MotoCorp’s strong dealership and service network. By leveraging Hero’s brand credibility and mass-market reach, Vida is rapidly establishing itself as a go-to option for affordable and reliable electric scooters, appealing to a wider audience.

5. Ola Electric – Sharp Decline

Now comes the biggest shock.

Latest month sales: 7,516 units

January 2025 sales: 24,413 units

Growth: 69.21% decline

While the overall market is growing by nearly 25%, Ola’s sales have dropped drastically. Factors like supply chain challenges, production delays, and rising competition have impacted Ola’s momentum, signaling the need for strategic adjustments to regain consumer confidence in a fiercely growing EV market.

Other EV Brands Performance

Apart from the top 5 brands, several smaller players are steadily making their presence felt:

Ampere Vehicles (Greaves Ampere): 5,337 units

River Mobility: 2,587 units

Bgauss: 2,477 units

E-Sprinto: 2,033 units

Other brands combined: 7,405 units

These numbers show that India’s EV market is becoming increasingly competitive, with multiple players vying for attention. Smaller brands are focusing on affordability, niche segments, and city-focused mobility solutions, gradually expanding consumer choices and driving overall market growth. Even though they lag behind the market leaders, their innovation and pricing strategies are helping them carve out meaningful shares in this rapidly evolving space.

Why Ola Electric Sales Are Declining in 2026 Despite Market Growth?

This is the most important question.

When the market is growing, why is Ola losing sales?

There are several possible reasons.

1. Increased Competition

Earlier, Ola was the dominant EV brand. But now strong players like TVS, Bajaj, Ather, and Vida have expanded aggressively. Traditional companies already have established service centers and dealer networks.

Customers now have more reliable alternatives.

2. Service & Customer Complaints

Ola has faced criticism regarding after-sales service, spare parts availability, and service delays in some regions. In the EV market, customer trust and service support are extremely important.

Brands with better service networks are gaining advantage.

3. Distribution Strategy

Unlike traditional brands, Ola initially followed a direct-to-consumer model instead of a large dealership network. While innovative, this approach may have limited physical presence compared to competitors with thousands of service centers.

Customers often prefer brands with nearby service support.

4. Brand Perception Shift

When Ola launched, it was seen as a tech disruptor. But now competitors are offering similar smart features, better build quality, and competitive pricing.

The “first mover advantage” is reducing.

5. Pricing & Value Comparison

With more options available, customers are comparing price, range, battery warranty, and resale value more carefully. Some customers may find better overall value in other brands.

Market Trend Analysis

The key insight is this:

Total market growth: 24.77% increase

Top brands like TVS and Ather: Strong double-digit growth

Hero Vida: Massive triple-digit growth

Ola: Heavy decline

This shows the market demand is strong, but competition is reshaping leadership.

The Indian EV space is no longer a single-brand dominated market. It is becoming competitive and mature.

What Could Help Ola Recover?

To regain momentum, Ola may need to:

Strengthen service infrastructure

Improve customer support

Expand physical presence

Focus on product quality and reliability

Offer strong pricing and warranty benefits

If improvements happen, recovery is possible because the EV market itself is expanding rapidly.

Conclusion

India’s electric two-wheeler market is growing strongly in 2026. Total sales have increased significantly year-on-year, showing rising EV adoption.

Brands like TVS Motor Company, Bajaj Auto, Ather Energy, and Vida are gaining market share.

However, Ola Electric is facing a sharp decline despite overall market growth. The reasons likely include rising competition, service challenges, and shifting consumer preferences.

The Indian EV industry is entering a new phase where brand trust, service quality, and product reliability matter more than just aggressive marketing.

The coming months will decide whether Ola can regain its leadership — or whether traditional players will continue dominating India’s electric scooter market.

FAQs: Electric Two-Wheeler Sales Report – Brands Growth Trend Amid Ola’s Decline

Q1. Which electric two-wheeler brand is currently leading the Indian market?

A: TVS Motor Company is the market leader in India’s electric two-wheeler segment, with latest month sales of 34,558 units. The brand has seen a 43.82% growth compared to January 2025, driven by strong product reliability, customer trust, and an extensive service network.

Q2. How is Bajaj Auto performing in the EV segment?

A: Bajaj Auto holds the second position with 25,598 units sold in the latest month, marking a 19.23% growth from January 2025. Its performance benefits from a wide dealership network, growing acceptance of its electric scooters, and the brand’s longstanding reputation for durability.

Q3. Which brand has shown the fastest growth recently?

A: Vida, Hero MotoCorp’s EV brand, has recorded the fastest growth, jumping 718% from 1,626 units in January 2025 to 13,302 units in the latest month. This surge is attributed to Hero’s strong dealership network, affordability, and brand trust.

Q4. Why has Ola Electric’s sales declined sharply?

A: Ola Electric’s sales have dropped 69.21% compared to January 2025, falling to 7,516 units. Contributing factors include production delays, supply chain challenges, and rising competition from brands like TVS, Bajaj, and Vida, highlighting the need for strategic adjustments.

Q5. How are smaller EV brands performing in India?

A: Other players such as Ampere Vehicles, River Mobility, Bgauss, and E-Sprinto continue to grow steadily, with combined sales of over 17,800 units in the latest month. These brands are focusing on affordability, city mobility solutions, and niche segments, gradually expanding their market share.

Q6. What trends are visible in India’s electric two-wheeler market?

A: The Indian EV market shows a strong preference for established brands with reliable after-sales support, while tech-focused and premium scooters are gaining traction among urban buyers. Additionally, affordable, city-oriented EVs from smaller brands are contributing to the overall market growth.

Q7. Is the overall market for electric two-wheelers growing despite Ola’s decline?

A: Yes, the overall market is growing by nearly 25% despite Ola’s decline. This growth is driven by strong performances from TVS, Bajaj, Ather, Vida, and other emerging EV brands, indicating rising consumer acceptance and adoption of electric mobility in India.